Our plan options

High Option

Plan Features

- $0 copay for telehealth — always

- Lowest copays

- Most out of pocket costs are copays

- $0 deductible

Best option if you

- Anticipate frequent care visits

- Want predictable and low out-of-pocket costs

Standard Option

Plan Features

- $0 copay for telehealth — always

- Lower premium than High Option

- Most out of pocket costs are copays

- $0 copays for children

- $0 for inpatient maternity

- $0 deductible

Best option if you

- Want a lower premium and predictable out-of-pocket costs

- Have young children or plan to start a family

Prosper

Plan Features

- $0 copay for telehealth — always

- Our lowest premium option

- Most out of pocket costs are copays

- $100 deductible

Best option if you:

- Are in good overall health

- Want to pay the lowest premiums

High Option

| Enrollment Code | Bi-weekly | Monthly |

|---|---|---|

| Self only (621) |

$99.93 | $216.51 |

| Self + 1 (623) |

$270.70 | $586.52 |

| Self & Family (622) |

$219.80 | $476.24 |

Standard Option

| Enrollment Code | Bi-weekly | Monthly |

|---|---|---|

| Self only (624) |

$60.92 | $132.00 |

| Self + 1 (626) |

$140.81 | $305.08 |

| Self & Family (625) |

$140.81 | $305.08 |

Prosper

| Enrollment Code | Bi-weekly | Monthly |

|---|---|---|

| Self only (FL1) |

$42.15 | $91.33 |

| Self + 1 (FL3) |

$96.96 | $210.07 |

| Self & Family (FL2) |

$118.03 | $255.74 |

These rates do not apply to all enrollees. If you are in a special enrollment category, please refer to the FEHBP Program website or contact the agency or Tribal Employer which maintains your health benefits enrollment.

2023 Summary of Benefits

| High Option | Standard Option | Prosper | |

|---|---|---|---|

| Deductible | None | None | $100 |

| 2023 Benefits and Services | |||

| Outpatient services | |||

| Preventive care | $0 | $0 | $0 |

| Telehealth | $0 | $0 | $0 |

| Primary care office visit | $15 | $30 ($0 for children through age 17) | $30 |

| Specialty care office visit | $25 | $40 ($0 for children through age 17) | $40 |

| Laboratory tests | $0 | $10 | $101 |

| X-rays | $0 | $10 | $101 |

| Chiropractic and acupuncture services – 20 combined visits per year | $15 | $15 | Not covered |

| Maternity | |||

| Routine prenatal care and postpartum visit | $0 | $0 | $0 |

| Delivery | $250 | $0 | $7501 |

| Hospital services | |||

| Outpatient surgery | $50 | $200 | $3001 |

| Inpatient hospital | $250 | $500 | $7501 |

| Emergency and urgent care | |||

| Urgent care | $15 | $30 ($0 for children through age 17) | $30 |

| Emergency care | $100 | $150 | $1501 |

| Ambulance | $50 | $150 | $2001 |

| Prescription drugs | |||

| Generic | $10 | $15 | $15 |

| Brand | $40 | $50 | $60 |

| Specialty | $100 | $150 | $200 |

| Out-of-pocket maximum | $2,000 | $3,000 | $5,000 |

1 Deductible applies.

Notes:

- Telehealth options include video, phone, email and more.

- Prescription drug copayments are for a 30-day supply at Kaiser Permanente pharmacies. You pay only 2 copays for up to a 100-day supply for most drugs through Kaiser Permanente’s mail-order program.

- Deductible and out-of-pocket maximum amounts are per person, but no more than 2 times per family.

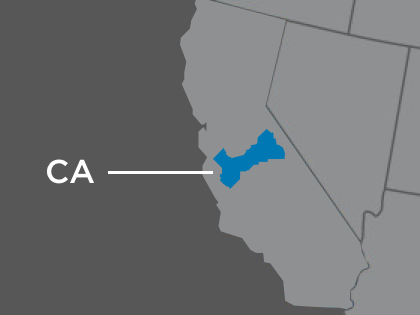

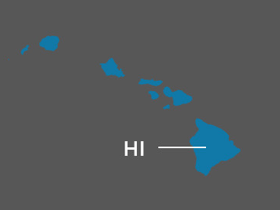

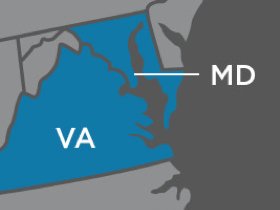

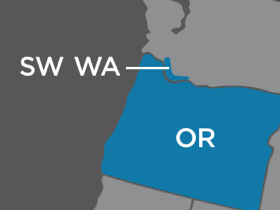

This is a summary of the features of the Kaiser Permanente – Southern California FEHB plan. Before making a final decision, please read the Plan’s Federal brochure (RI 73-822). All benefits are subject to the definitions, limitations, and exclusions set forth in the Federal brochure.

Ready to enroll?

Care for growing families

There’s no better place to plan, start, and raise your family because you’re all at the center of everything we do. Check out what you get with your health plan and discover how your dollars go further with Kaiser Permanente.

Learn more about care for growing families >